Unknown Facts About Estate Planning Attorney

Unknown Facts About Estate Planning Attorney

Blog Article

Some Known Details About Estate Planning Attorney

Table of ContentsThe Buzz on Estate Planning AttorneyEstate Planning Attorney Fundamentals ExplainedThe Facts About Estate Planning Attorney RevealedThe Buzz on Estate Planning AttorneyOur Estate Planning Attorney DiariesThe Single Strategy To Use For Estate Planning Attorney3 Simple Techniques For Estate Planning Attorney

That you can stay clear of Massachusetts probate and sanctuary your estate from estate taxes whenever possible. At Facility for Senior Citizen Law & Estate Preparation, we recognize that it can be challenging to assume and speak about what will take place after you die.We can aid. Call and set up a free assessment. You can additionally reach us online. Serving the better Boston and eastern Massachusetts areas for over 30 years.

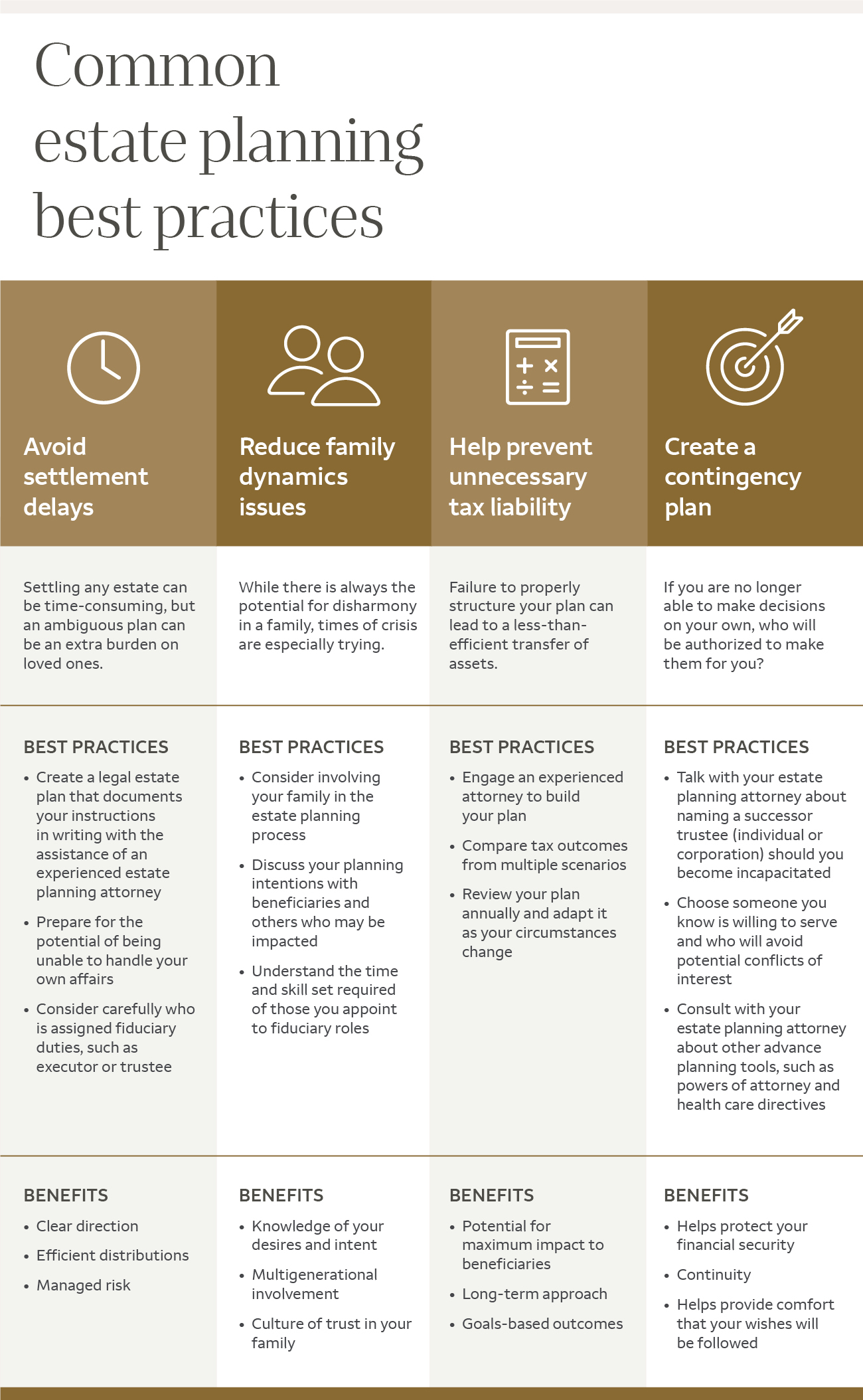

They aid you create a detailed estate plan that straightens with your desires and goals. Estate intending attorneys can aid you avoid errors that might revoke your estate strategy or lead to unintended consequences.

Some Ideas on Estate Planning Attorney You Should Know

Probate is a lawful process that takes place after someone passes away, where the court decides just how their assets are distributed. Working with an estate preparation attorney can assist you avoid probate altogether, conserving time, and cash. An estate planning lawyer can help shield your possessions from claims, financial institutions, and other claims. They'll create a plan that guards your possessions from possible threats and makes sure that they most likely to your designated beneficiaries.

To find out regarding real estate,. To learn concerning wills and estate preparation,.

The age of majority in a given state is set by state legislations; typically, the age is 18 or 21. Some assets can be dispersed by the establishment, such as a financial institution or broker agent firm, that holds them, so long as the owner has actually offered the correct directions to the banks and has called the beneficiaries that will certainly obtain those assets.

Our Estate Planning Attorney Ideas

For instance, if a beneficiary is called in a transfer on death (TOD) account at a brokerage company, or payable on death (COVERING) account at a financial institution or credit rating union, the account can typically pass straight to the beneficiary without experiencing probate, and hence bypass a will. In some states, a similar beneficiary classification can be included in realty, permitting that property to also bypass the probate procedure.

When it involves estate planning, a skilled estate lawyer can be a vital property. Estate Planning Attorney. Dealing with an estate planning attorney can give various advantages that are not available when attempting to finish the procedure alone. From supplying proficiency in lawful matters to aiding produce a comprehensive plan for your household's future, there are lots of advantages of collaborating with an estate preparation lawyer

Estate attorneys have comprehensive experience in understanding the nuances of various legal files such as wills, depends on, and tax regulations which permit them to supply audio recommendations on how best to secure your assets and guarantee they are given according to your desires. An estate attorney will additionally have the ability to provide advice on how finest to navigate complex estate laws in order to make certain that your wishes are honored and your estate is taken care of properly.

10 Easy Facts About Estate Planning Attorney Explained

They can typically provide suggestions on how ideal to update or create new records when needed. This may consist of advising adjustments in order to benefit from new tax benefits, or just ensuring that all site here pertinent papers reflect one of the most present recipients. These lawyers can likewise supply continuous updates associated to the administration of trust funds and various other estate-related matters.

The objective is constantly to make sure that all documentation remains lawfully precise and shows your current dreams properly. A significant advantage of dealing with an estate preparation attorney is the very useful advice they give when it involves avoiding probate. Probate is the lawful procedure throughout which a court determines the legitimacy of a departed person's will certainly and manages the distribution of their possessions based on the regards to that will.

A knowledgeable estate attorney can assist to guarantee that all needed files remain in place and that any type of assets are correctly distributed according to the terms of a will, staying clear of probate altogether. Inevitably, collaborating with a seasoned estate planning lawyer is among the best means to ensure your long for your family members's future are carried out as necessary.

They provide crucial legal support to ensure that the very best rate of interests of any small youngsters or adults with impairments are totally safeguarded (Estate Planning Attorney). In such instances, an estate lawyer will certainly assist recognize suitable guardians or conservators and ensure that they are offered the authority essential to handle the possessions and events of their charges

See This Report on Estate Planning Attorney

Such depends on usually include provisions which safeguard this post benefits obtained through government programs while enabling trustees to keep minimal control over just how properties are taken care of in order to optimize advantages for those entailed. Estate attorneys understand just how these trusts work and can offer invaluable assistance establishing them up effectively and making certain that they stay legally certified over time.

An estate planning lawyer can assist a parent consist of stipulations in their will for the treatment and administration of their minor children's possessions. Lauren Dowley is an experienced estate planning attorney who can help you develop a plan that satisfies your important link particular needs. She will certainly collaborate with you to comprehend your assets and exactly how you want them to be distributed.

Do not wait to start estate planning! It's one of the most vital points you can do for on your own and your loved ones.

The Ultimate Guide To Estate Planning Attorney

Producing or upgrading existing estate preparation records, consisting of wills, counts on, health and wellness treatment regulations, powers of attorney, and related devices, is just one of the most vital things you can do to ensure your desires will certainly be recognized when you pass away, or if you become not able to manage your events. In today's electronic age, there is no shortage of diy choices for estate preparation.

Nonetheless, doing so could lead to your estate strategy refraining what you desire it to do. Working with an estate planning lawyer to prepare and aid implement your lawful files is a clever decision for a selection of reasons:. Wills, trust funds, and various other estate planning papers should not be something you prepare as soon as and never review.

Probate and trust legislations are state-specific, and they do alter from time-to-time. Collaborating with a lawyer can offer you tranquility of mind understanding that your strategy fits within the specifications of state law. Among the greatest mistakes of taking a diy strategy to estate preparation is the danger that your files will not really complete your objectives.

9 Easy Facts About Estate Planning Attorney Explained

They will certainly take into consideration numerous situations with you to prepare papers that precisely mirror your wishes. One usual misconception is that your will certainly or depend on instantly covers every one of your possessions. The truth is that certain types of residential or commercial property ownership and recipient classifications on possessions, such as retired life accounts and life insurance policy, pass independently of your will or trust fund unless you take steps to make them work together.

Report this page